Last Updated:

Mahindra

New Delhi. These days, compact SUV cars are dominating the Indian automobile market. In the last few years, cars of this segment have gained tremendous popularity in the Indian market and have left behind hatchback and sedan cars which were the first choice of Indian customers a few years ago. Now if you are thinking of getting a new compact SUV then Mahindra XUV 3XO MX2 is a great option for you. MX2 is the diesel variant of this car. If your budget is tight and you cannot pay lump sum for this car, then you can finance it with a downpayment of Rs 2 lakh. Come, let us know about this in details.

Onroad Price with RTO and Insurance

Mahindra sells MX2 as the diesel variant of XUV 3XO. The ex-showroom price of the entry level variant of this vehicle is Rs 8.95 lakh. Suppose you buy this SUV in Delhi, then you will have to pay RTO of around Rs 78,000 and insurance of around Rs 45,000. After which Mahindra XUV 3XO MX2 on-road price will reach around Rs 10.18 lakh.

Downpayment of Rs 2 lakh

If you want to bring home the diesel variant MX2 of this vehicle after making a down payment of Rs 2 lakh, then you will have to take the remaining Rs 8.18 lakh as a loan from the bank. If the bank is giving you a loan of Rs 8.18 lakh at an interest rate of 9% for 7 years, then you will have to pay Rs 13309 as EMI every month.

How much will the car cost?

Suppose you take a car loan of Rs 8.18 lakh from a bank at 9 percent interest for 7 years, then you will have to pay EMI of Rs 13309 every month. This means you will have to pay around Rs 2.99 lakh as interest for the diesel variant MX2 of Mahindra XUV 3XO for 7 years. After which the total price of this SUV for you will become Rs 13.17 lakh.

compete with these vehicles

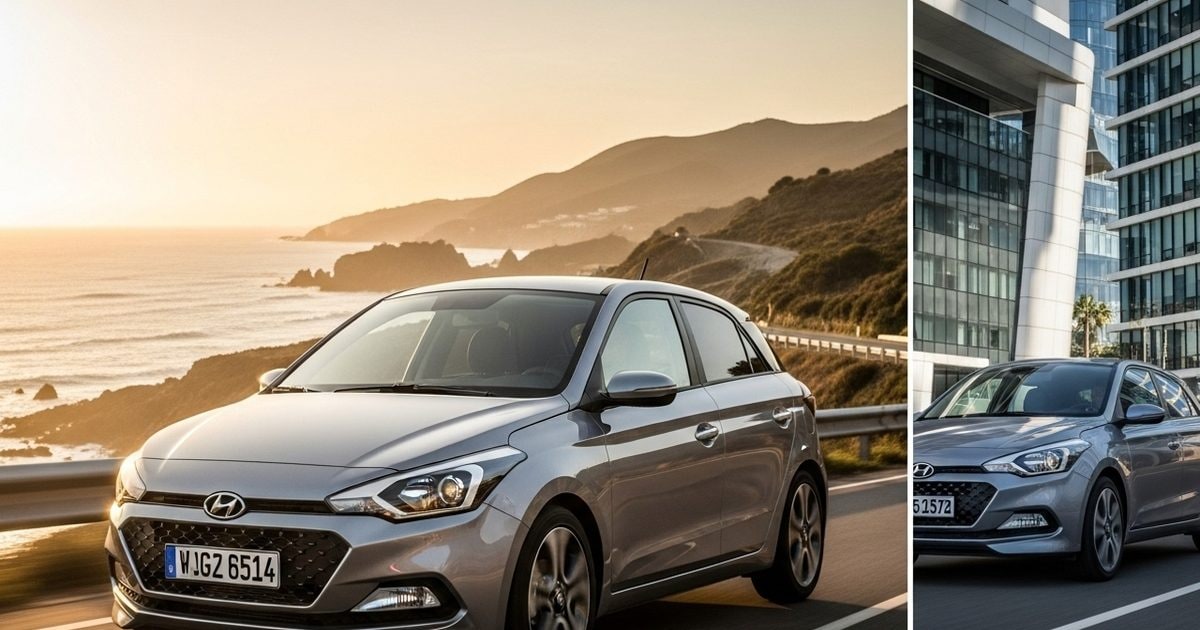

The company offers Mahindra XUV 3XO MX2 as a compact SUV i.e. 4 meter long SUV. In this segment, it competes directly with vehicles like Renault Kiger, Maruti Breeza, Tata Nexon, Kia Sonet, Hyundai Venue and Nissan Magnite which are already quite popular in the market.