One of the defining developments of the year was the implementation of GST 2.0 reforms, which recalibrated the taxation structure for automobiles. Small cars, which form the backbone of first-time buyers’ mobility, saw a reduction in GST from 28 per cent to 18 per cent. This policy change made affordable cars more accessible to the burgeoning middle class, particularly in smaller cities and towns where such vehicles dominate household mobility.

Simultaneously, larger cars over four meters in length and premium motorcycles above 350cc were subjected to a fixed 40 per cent tax. The reforms not only reduced costs for buyers but also simplified the taxation framework, creating predictability in pricing and enabling dealerships to offer attractive deals during festival seasons.

Auto Retail Grows 3.4 per cent in H1 FY’26:

India’s automobile retail sector recorded steady growth in the first half of FY’26 (April–September 2025), with total vehicle registrations rising 3.42 per cent year-on-year to 1,23,48,306 units, up from 1,19,39,890 units in the same period last year. The latest data highlights broad-based recovery across most vehicle categories, though growth remained moderate amid mixed economic indicators.

Two-wheelers continued to dominate the market, registering 88,37,140 units, a 3.07 per cent increase from a year ago. Accounting for over 71 per cent of total sales, the segment remains the primary volume driver for the industry. Demand was buoyed by improving rural sentiment, easing financing conditions, and steady traction for entry-level commuter bikes and scooters. Passenger vehicles (PVs) grew 3.67 per cent to 19,50,586 units, reflecting sustained momentum in the SUV and crossover segments. The category contributed nearly 16 per cent to overall registrations, aided by festive bookings and a widening choice of hybrid and electric variants.

In the tractor segment, sales surged 10.68 per cent to 4,48,987 units, marking the sharpest growth among all categories. The rise signals a recovery in rural markets and healthy pre-harvest demand. Three-wheelers also expanded 3.86 per cent to 6,18,225 units, supported by increasing adoption of electric passenger and cargo models for urban last-mile mobility. Meanwhile, commercial vehicles (CVs) recorded a modest 2.56 per cent uptick to 4,60,475 units, indicating stable freight and infrastructure activity despite broader macroeconomic headwinds.

The first half of FY’26 shows an encouraging mix of growth across personal and rural mobility segments, even as the construction equipment category declined slightly. With the festive season underway, industry players are optimistic that retail demand will strengthen further in the coming quarters.

Also Read : Festive demand, GST cuts lift Navratri car sales 35 per cent, overall retails up 6 per cent

Big Shakedown: Tata Reclaims No. 2 Spot on Record SUV, Small Car Sales

Festival season sales in 2025 underscored the profound impact of GST 2.0 on consumer behaviour. Automakers reported some of the highest monthly retail numbers in recent history, driven by pent-up demand, strategic pricing, and festive promotions. While Maruti Suzuki maintained its dominance as India’s leading car brand, Tata Motors recorded its highest-ever retail sales in September 2025, reclaiming the second position in the country’s overall passenger vehicle market.

Tata Motors posted its strongest monthly performance ever, selling a historic 60,907 units in September 2025, a remarkable 47 per cent year-on-year growth. This surge helped Tata reclaim the second spot among India’s best-selling car brands, overtaking Hyundai, which saw a slowdown during the period. The Tata Nexon SUV spearheaded the rally, recording its highest-ever monthly sales for any Tata model with over 22,500 units delivered.

Following the rollout of GST 2.0 reforms in 2025, Honda reduced prices across key models—the Amaze, City, and Elevate—by as much as ₹1.2 lakh. The strategy has clearly paid off, with the company recording a strong 15.3% year-on-year rise in domestic sales in October 2025, led primarily by renewed demand for the Amaze. By passing the tax benefits directly to buyers, Honda has effectively improved the affordability of its lineup, helping attract more customers during the crucial festive season.

“We welcome the Government’s GST Reforms 2025 which came at a very timely juncture for the Auto industry. These progressive measures have not only made vehicles more accessible to customers but also provided a strong impetus to festive season demand,” said Kunal Behl, Vice President, Marketing & Sales, Honda Cars India Ltd.

Navratri 2025 marked a record-breaking festive season for automobile retail in India. Reflecting on the same, FADA Vice President, Sai Giridhar said, “Navratri 2025 will go down as one of the most memorable chapters in India’s automobile retail journey — a true ‘Bachat Utsav’ unleashed by the visionary GST 2.0 reform announced by Hon’ble Prime Minister Shri Narendra Modi ji. For the first time ever, dealerships across the nation witnessed record-breaking footfalls and deliveries, with overall retail surging by 34 per cent YoY — a historic high during any festive season.”

The combination of pricing incentives, festival-driven purchases, and strategic marketing created a surge in demand that exceeded expectations. Automakers reported that a significant proportion of these sales came from new buyers entering the market, signalling a demographic shift towards aspirational purchases rather than purely utilitarian choices.

Electrification Gains Momentum

The EV segment continued to expand, reinforced by its structural tax advantage of 5 per cent GST. Several automakers, including BYD, Tata, MG Motor, and Mahindra, expanded their electric vehicle portfolios, launching affordable and mid-range EVs alongside premium electric SUVs. Startups like Ultraviolette, Oben, and Ola Electric played a complementary role, bringing smaller, technology-driven EVs and scooters to urban consumers.

EVs attracted buyers not only because of low GST rates but also due to lower running and maintenance costs. However, price parity with ICE vehicles remained challenging because of high battery costs, limited domestic manufacturing scale, and the need for imported components such as lithium-ion cells. Despite this, the industry witnessed a clear trend: urban buyers, professionals, and environmentally conscious consumers increasingly considered EVs as viable alternatives for personal mobility.

Also Read : BYD overtakes Tesla to secure pole position in electric car race

Global EV players knock on Indian doors:

Tesla’s India Entry: After years of speculation and stalled negotiations, American electric vehicle giant Tesla finally made its official debut in India, marking a watershed moment for the country’s fast-evolving EV landscape. The company, led by billionaire Elon Musk, inaugurated its first retail and service centre in Mumbai’s Bandra Kurla Complex in July 2025, with the Model Y becoming the brand’s maiden offering for Indian buyers.

Priced around ₹60 lakh (ex-showroom), the Model Y positions Tesla firmly in the premium EV segment, competing with the likes of the BYD Seal, Hyundai Ioniq 5, and Volvo XC40 Recharge. While initial batches are being imported as completely built units (CBUs), industry sources suggest Tesla is already scouting sites in Maharashtra and Gujarat for potential local assembly operations.

The company is also laying the groundwork for its famed Supercharger network, with the first V4 fast-charging station already operational in Delhi. Tesla’s India website is live, allowing customers to configure and book their cars online. Deliveries of the Model Y electric SUV have commenced across India in a phased rollout.

Despite the excitement, challenges remain. Import duties, even under the revised policy, keep Tesla’s vehicles out of reach for most Indian buyers. Moreover, India’s charging infrastructure and battery supply chain are still at a nascent stage. Domestic players like Tata Motors and Mahindra are already dominating the affordable EV space, making Tesla’s task of scaling up in India a steep climb.

VinFast enters India with global electric SUV lineup:

The Vietnamese electric vehicle manufacturer VinFast has officially entered the Indian market, unveiling its first two models — the VF 6 and VF 7. It also officially inaugurated its electric vehicle (EV) assembly plant at the SIPCOT Industrial Park in Thoothukudi, Tamil Nadu, marking the company’s formal entry into India’s rapidly expanding EV manufacturing landscape.

VinFast’s Tamil Nadu facility is spread across 400 acres with an initial annual capacity of 50,000 units, scalable up to 150,000 units. This facility is the company’s third operational plant and the fifth project in its global manufacturing network. As its first production base outside Vietnam, the site underscores VinFast’s global ambitions and its capability to execute large-scale projects. India is set to become VinFast’s key export hub for right-hand-drive markets. VinFast’s entry signals growing confidence among global EV makers in India’s electrification roadmap and the government’s push toward cleaner mobility.

Also Read : VinFast crosses 1 lakh sales in Vietnam within 9 months

Indian auto industry: The road ahead

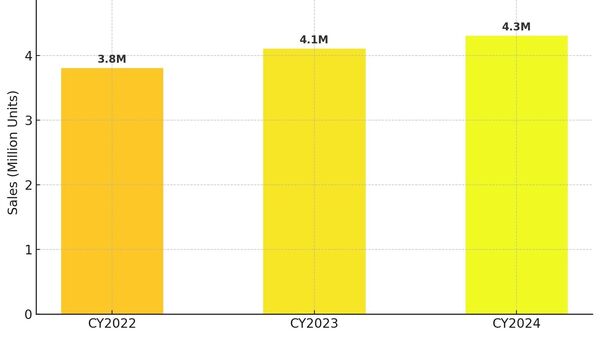

India’s automobile market stands on the cusp of a structural transformation, driven by accelerated electrification, policy-backed localisation, and a strong rebound in domestic demand. With over 4.3 million passenger vehicles sold last year, India has firmly cemented its position as the world’s third-largest auto market, but the next phase will be defined more by technology and sustainability than sheer volume.

The government’s new EV policy—offering reduced import duties for automakers committing to local production—has set the stage for global entrants such as Tesla, VinFast, and BYD to establish a footprint in India. Meanwhile, domestic manufacturers like Tata Motors, Mahindra, and Maruti Suzuki are investing heavily in dedicated EV platforms, battery plants, and connected vehicle ecosystems. Analysts expect EV penetration in passenger cars to rise from the current 3–4 per cent to over 15 per cent by 2030.

Electrification aside, the industry’s evolution will hinge on advanced manufacturing and supply chain localisation. The Production-Linked Incentive (PLI) scheme is catalysing investment in semiconductor components, lithium-ion battery modules, and hydrogen fuel cell systems. Automakers are also transitioning toward software-defined vehicles, integrating over-the-air updates, AI-based driver assistance, and telematics-driven predictive maintenance.

However, the road is not without speed bumps. Charging infrastructure expansion, raw material dependency for battery production, and high acquisition costs continue to slow mass adoption. The ICE (internal combustion engine) segment will remain relevant for the near term, supported by biofuels, CNG, and hybrid technologies.

Still, industry experts view this decade as India’s inflection point—a shift from being a low-cost manufacturing base to a mobility innovation hub. With rising exports, evolving powertrain diversity, and deepening R&D investments, the Indian auto industry is entering a high-tech, low-emission era that could redefine its global competitiveness.

Retail Data Source: FADA Research

Get insights into Upcoming Cars In India, Electric Vehicles, Upcoming Bikes in India and cutting-edge technology transforming the automotive landscape.

First Published Date: 14 Oct 2025, 11:58 am IST